MAKING ‘CENTS’ WITH MONEY

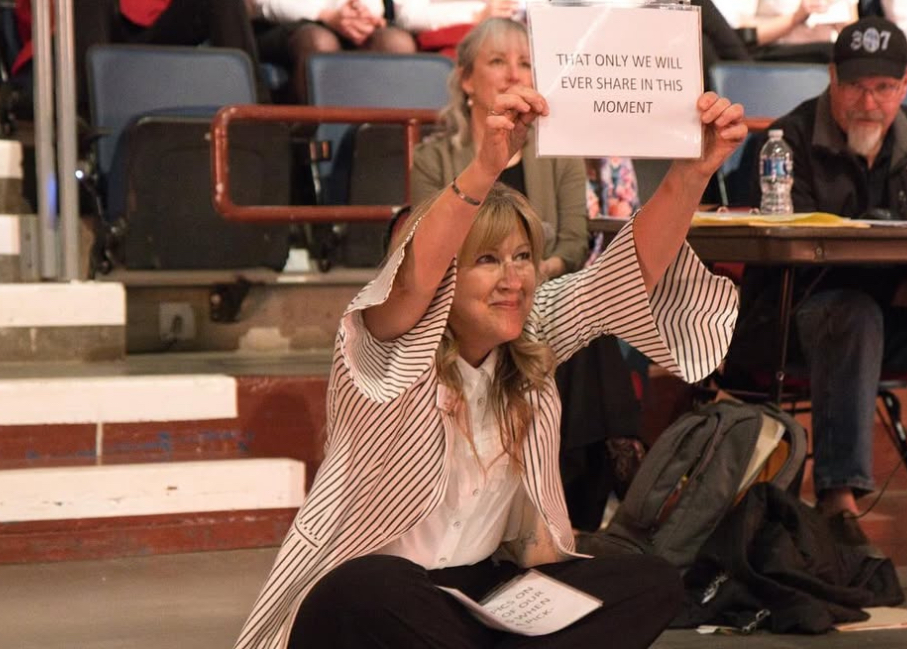

Mr. Vin Cappiello looking disappointed whilst looking in senior Hailey Carner’s empty wallet.

When it comes to saving money, I’m the last person from whom you should take financial advice. I spend my days (and paychecks) binge-eating Lunchables and Gushers while sipping on iced coffee and watching reruns of The Office on Hulu, which I also pay for.

But because of my crappy experience with saving money over the past couple of years, I have learned some strategies to still do everything I love (eating junk food and watching Hulu) while managing not to break the bank. Hopefully you’ll take some of this into consideration and not make the same mistakes I did.

Whether you’re set on the latest iPhone, a summer trip or maybe buying your first car, you have high hopes as a teen. Your parents might be willing to help you along the way, but earning your own income and saving money can make those achievements much more valuable and rewarding to you.

So consider the following:

- Start a savings account– yeah, yeah. I know it seems hard, especially if you’re not making a whole lot where you work. But a little here and there will benefit you in the end. Every paycheck, take $5 or $10 out of each one and add it to your savings account. I used to be unmotivated to put money in my savings account too, but contributing to my account on a regular basis and following my target established a sound financial management and resulted in better spending habits.

- Separate savings from spending money – oh yeah, just look at all of that money in your savings account waiting to be spent – it’s basically begging you, and burning a hole in your metaphorical pocket. You’re so tempted to buy those new Birkenstock’s or whatever it is you teens find so appealing, but don’t. Don’t give in to that taunting temptation. It’s like the devil calling out your name. Your savings should be for emergencies, not purchases like food or a new Thrasher hoodie. A smart thing to do is have a checking account, and a direct deposit account so you can always access your account on demand. This will help your goals from being conflicted with everyday purchases.

- Keep track of your spending– keeping a record of your spending definitely help to save money. It’s a great way to show if you’re spending more money than you should be. Save your receipts, and write down your spending total of each month. I know this sounds like something your parents would say, but there is some truth to it. If you’re not down with the old-school method of writing down your entries, try downloading apps such as YNAB, Good Budget, or Mint to help track your spending, and break down your expenditures into categories.

- Make use of coupons- since I’m such a foodie, I like to save coupons for when I make a trip to the grocery store. Remember when I said I tend to binge eat… a lot? Yeah this helps loads. I highly recommend this. They’re generally found with newspapers (yes, newspapers are still relevant other than to just start your campfire with), and they can be super useful. No, not just mom’s on a budget use a coupon book, so definitely look into one if you’re trying to save some cash.

- Just don’t leave the house– As a wise woman (junior Maggie Cappiello) once said: Just don’t leave the house. Enough said.

Good luck and happy savings.